BY HOWDEN

Key takeaways

Macroeconomic and geopolitical realignments, alongside persistent outsized natural catastrophes, have introduced significant uncertainty and volatility into the (re)insurance market.

Differing rate momentum reflects individual, mini-cycles with varying levels of sensitivity to losses and broader macro risks

Unlocking capital in order to find solutions for the risks of today (and tomorrow) will be crucial to maintaining relevance and offering clients coverage that meets their rapidly changing needs.

The great realignment

The world has become a riskier place. Any hope of a return to normality in the wake of COVID-19 has been shattered by a succession of geopolitical and macroeconomic shocks that brought war back to Europe, triggered an energy crisis and ended the era of cheap money and low prices.

The effects of COVID – huge fiscal and monetary stimulus, supply constraints and high debt burdens – have collided with the devastating fallout from Russia’s invasion of Ukraine to bring about a great realignment, characterised by structurally higher inflation, rising interest rates, heightened security threats and accelerated deglobalisation. Throw into the mix increased recessionary risk, turbulent financial markets, climate change, one of the most expensive natural disasters (Hurricane Ian), a challenged, if relenting, cyber market, and the operating environment is acute.

The corollary for risk managers and underwriters is a complex and nuanced (re)insurance market, driven by line specific, mini-cycles with varying levels of sensitivity to losses and broader macro risks. The big renewal story of the last 12 months has been the reversion of pricing cycles in the commercial insurance and reinsurance sectors, marked by price increase moderation overall for the former, albeit with strengthening in challenged areas, and rapid acceleration for the latter.

Reinsurance market

Having initially experienced lower pricing increases compared to those recorded in the commercial insurance market, the reinsurance sector reached its tipping point during mid-year renewals last year.

Macroeconomic and geopolitical realignments, alongside persistent outsized natural catastrophes, reset supply and demand dynamics in several areas, with buyers seeking to secure additional top-end cover in response to rising insured values and more premium entering the market. Demand-side pressures coincided with a severe capacity crunch, as capital providers (both rated carriers and ILS) pulled back whilst others were only willing to maintain allocations. The mismatch between supply and demand was already estimated to be in the tens of billions of dollars when Hurricane Ian hit Florida as a category 4 storm to reinforce one of the hardest reinsurance markets in living memory.

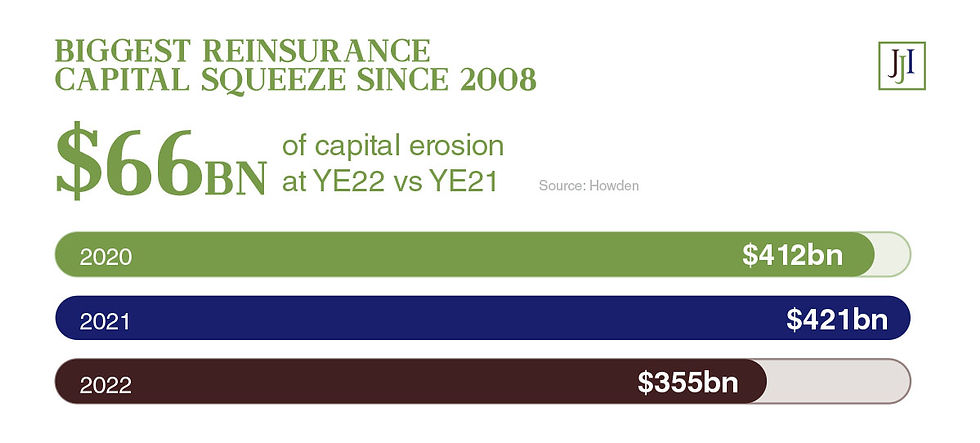

Asset-driven declines in dedicated reinsurance capital exacerbated capacity constraints at 1 January 2023. Whilst the sector’s strong gearing to investment-grade fixed income securities bolstered its capital position through the era of ultra-loose monetary policy, it is now navigating adverse impacts in response to rapidly changing inflation expectations and sharp decreases in the value of fixed income investments – especially at the short end of the curve where shorter-tail carriers tend to invest.

Source: Howden

Comments